taxable income malaysia 2017

Generally gains on capital assets are not subject to tax except for gains arising from the disposal of real property situated in Malaysia which is subject to RPGT see the Other. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia.

Malaysia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

This means that the more income you earn the higher amount of taxes you have to pay.

. Malaysia uses a progressive tax scheme. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Total tax payable.

Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. All types of incomes are taxable. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. If you are employed by a company in Malaysia and you earn a monthly income of more than RM 2500 that income is taxable meaning you have to pay a percentage of that income to. What kind of income will be taxed.

The calculation of individual threshold of non taxable income is taking into account after the deduction of annual gross income with eligible individual reliefs and tax rebates. In other words those who earn a minimum salary of about RM3000 a month should file their income tax. Taxable income band MYR.

The income tax rates are on Chargeable Income not salary or total. Malaysia adopts a progressive income tax rate system. For corporations the tax rate is 19 percent for the.

Accommodation provided by your. Originally only the income generated from. On the First 5000.

The Taxable Earning of Apple Incs annual report for the year 2017 can be calculated as Taxable Earning Net sales Research and development expense Selling general and administrative. Taxable income band MYR. Malaysia adopts a territorial principle of taxation meaning only income earned in Malaysia is taxable regardless of where the expatriate is paid.

1 company trip outside Malaysia for up to RM3000. Any benefits used only for the performance of your job duties. On the First 5000 Next 15000.

These are the types of income that are taxable. Effectively income tax will be imposed on resident persons in Malaysia on income derived from foreign sources and received in Malaysia with effect from 1 January 2022. Taxpayers only pay the higher rate on the amount above the rate.

RM 770 If the above is still not paid after 60 days you will be charged another 5 on the RM770 making your total tax payable come up to RM 80850. Taxable income band MYR. On the First 20000 Next.

Calculations RM Rate TaxRM 0 - 5000. THE government has made a surprising U-turn on Dec 30 2021 after announcing that foreign-sourced income received in Malaysia by Malaysian tax residents will be taxed. 3 company trips within Malaysia.

Hence you are also a tax resident in 2017 despite not fulfilling the 182-day requirement. A qualified person defined who is a knowledge.

Corporate Tax Rates Around The World Tax Foundation

Malaysian Income Tax 2017 Mypf My

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

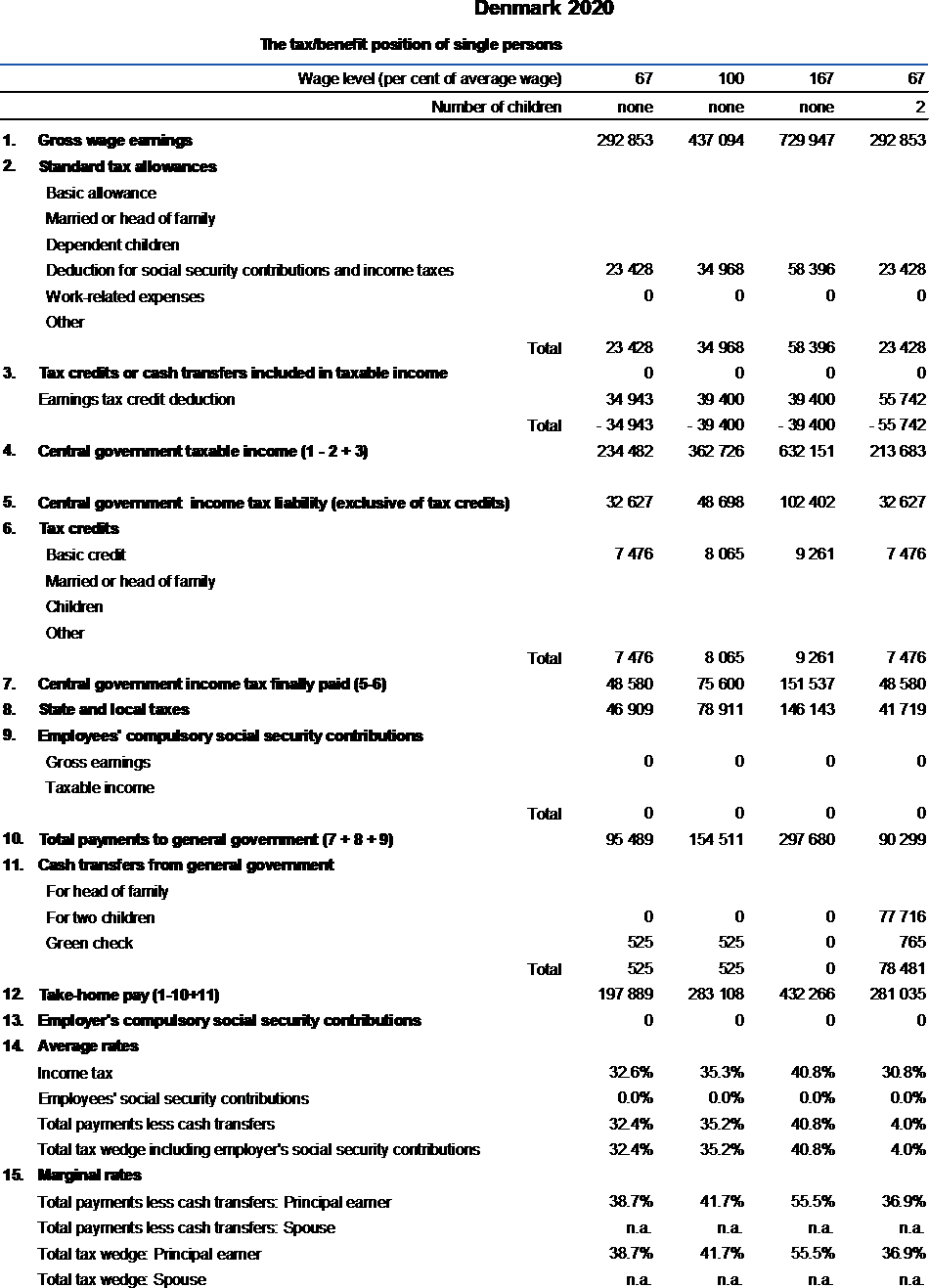

Denmark Taxing Wages 2021 Oecd Ilibrary

Business Tax Deadline In 2022 For Small Businesses

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Paying 2017 2018 Income Tax In Switzerland Read This Wise Formerly Transferwise

Why Black Women Are Paying More In Taxes Than Washington S Billionaires Ywca

Malaysian Taxation 101 Inheritance Tax And You Secure Your Seat Now Https Goo Gl M4jgpr Is Inheritance Tax A Fact Or Myth Richard Oon 25 Years Experience In Taxation Is Going To Share

Corporate Tax Rates Around The World Tax Foundation

Income Tax Malaysia 2018 Mypf My

The Purpose And History Of Income Taxes St Louis Fed

Doing Business In The United States Federal Tax Issues Pwc

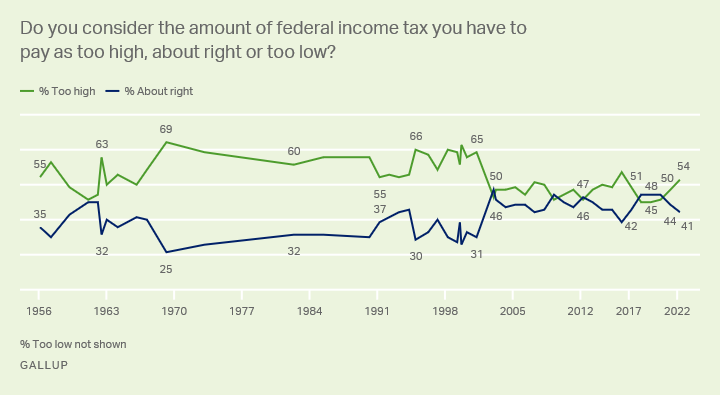

Taxes Gallup Historical Trends

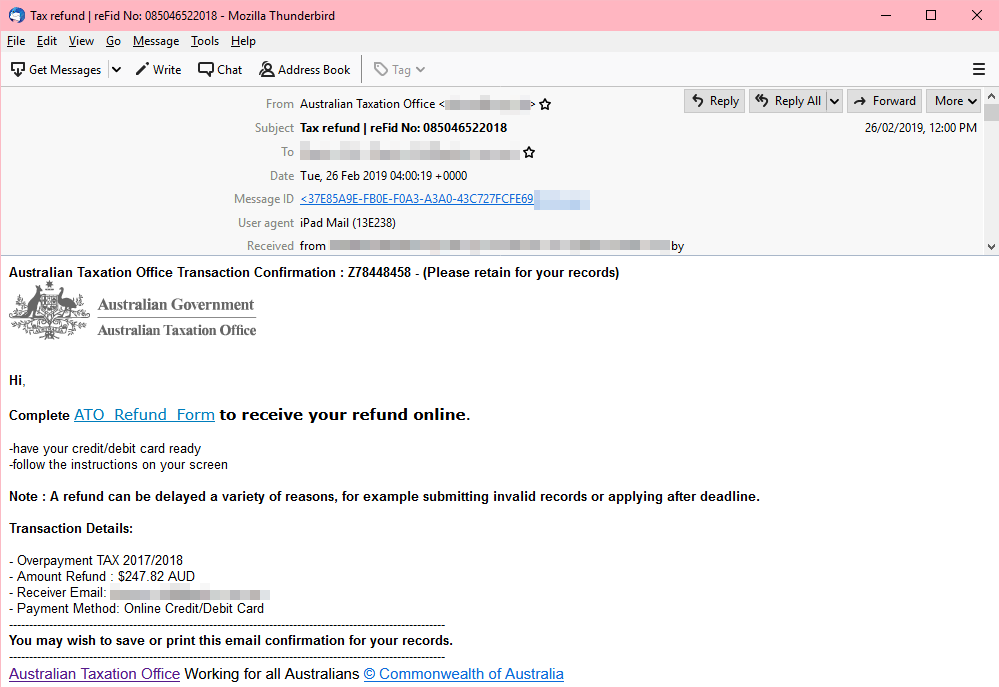

What You Need To Know About Tax Scams Security News

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

What Is Taxable Income With Examples Thestreet

0 Response to "taxable income malaysia 2017"

Post a Comment